Empower your tomorrow with solar brilliance transforming Energy, transforming lives

Switch to solar energy and enjoy the environmental and cost-saving benefits.

All Blog Posts

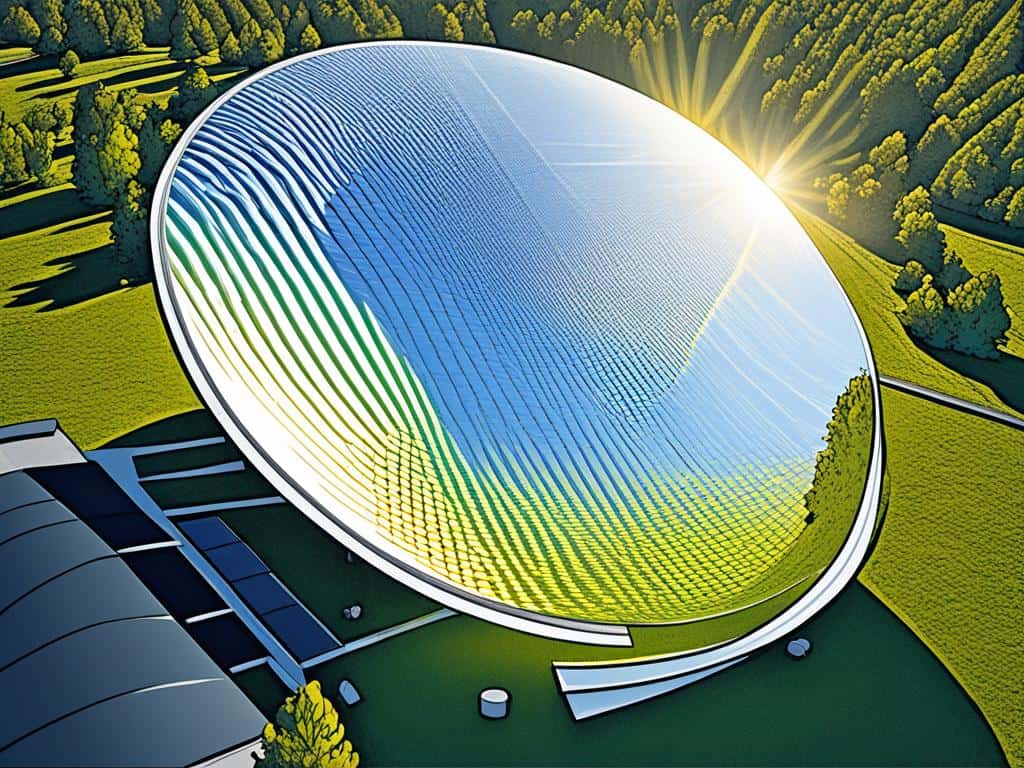

Harness Solar Power with a Parabolic Collector

Discover how a parabolic collector can revolutionize your energy consumption, tapping into the sun's power for efficient, clean energy in India.

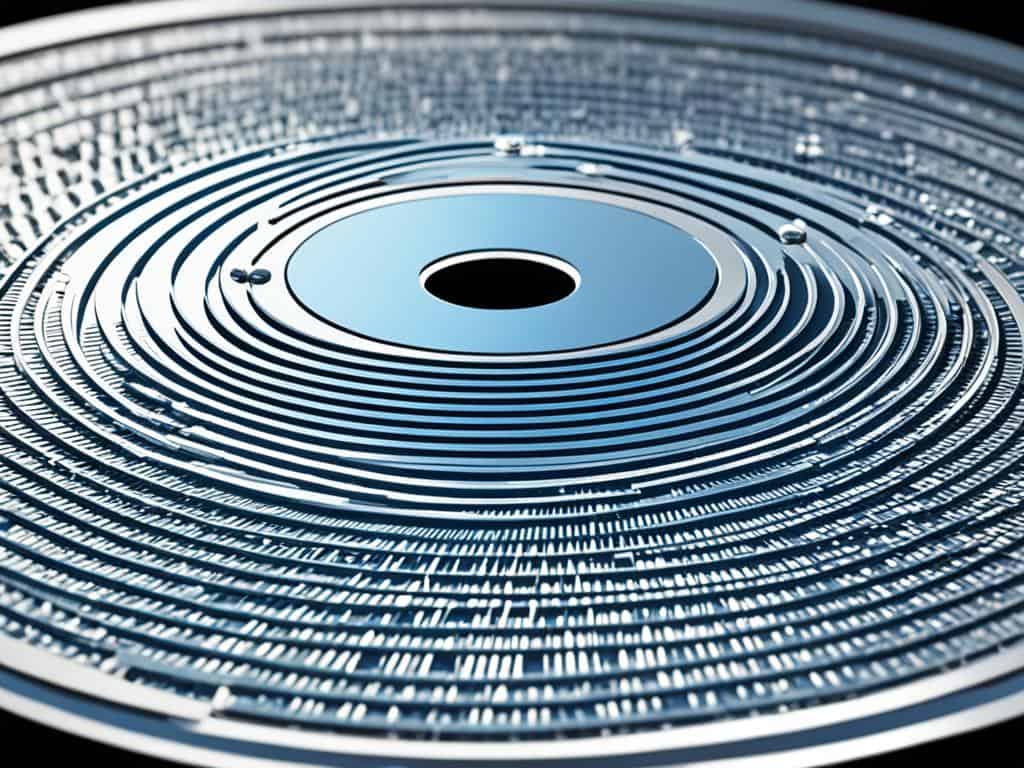

Innovative Solutions: Fresnel Lens Collectors Explained

Discover the power of fresnel lens collectors as they revolutionize solar…

Commercial Electricity Rates & Savings Guide

Unlock lower commercial electricity rates and discover savings strategies for your…

Top Commercial Meter Solutions for Businesses

Discover leading commercial meter solutions to optimize your business's energy management…

All Blog Posts

Accurate House Load Calculation Guide 2024

Master your home's energy needs with our comprehensive guide to house load calculation. Optimize comfort & savings in 2024 with expert tips.

Explore Pouch Cell Advantages in Modern Tech

Delve into the benefits of pouch cell technology and how it’s powering advancements in electronics across India. Discover its applications and perks today!

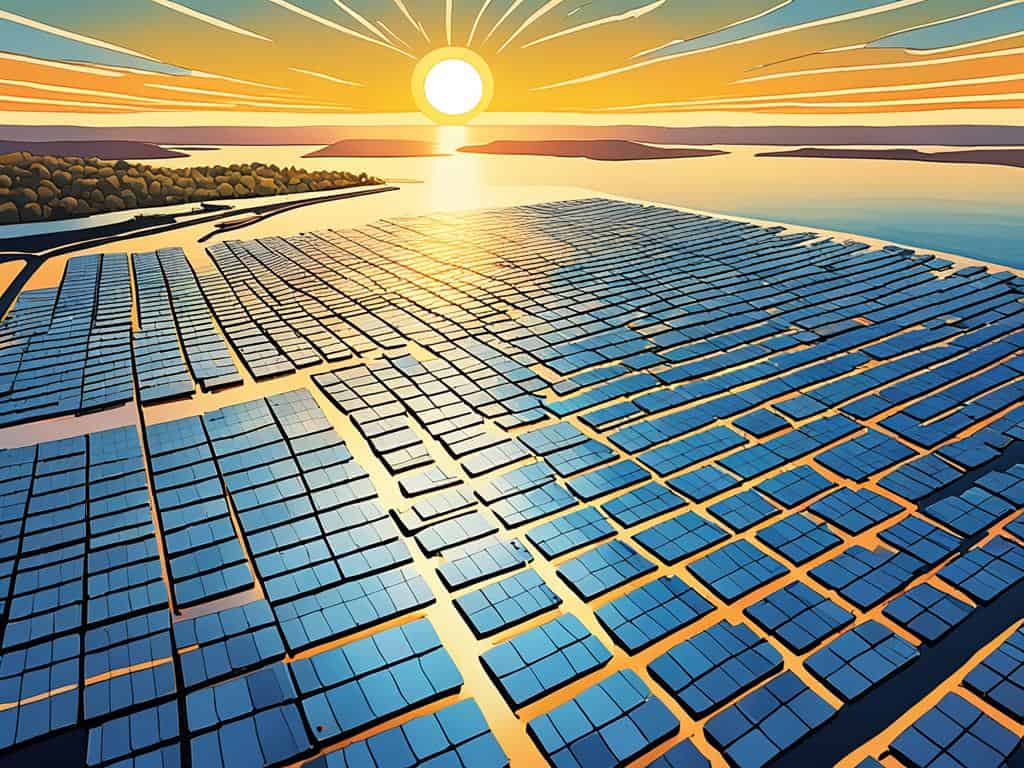

Flat Plate and Concentrating Collectors Explained

Explore the essentials of solar energy with our guide on flat plate and concentrating collectors, key to efficient renewable power in India.

How Liquid Flat Plate Collectors Work?

Unlock sustainable heating with liquid flat plate collectors – your efficient solution for harnessing solar energy in India. Learn how they work here!

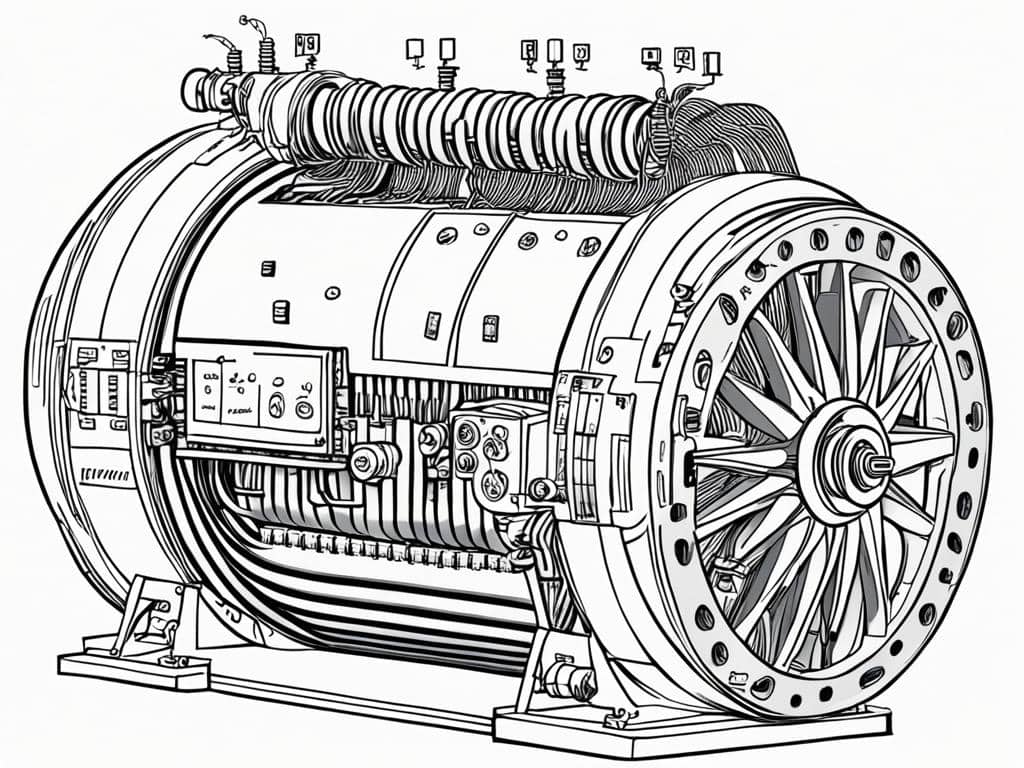

Transformer Calculation Formula Essentials

Unlock the essentials of transformer calculation formulas to optimize performance and efficiency in your electrical projects. Your engineering resource!

Maximizing Motor Performance: Understanding Full Load Current

Explore the essentials of motor efficiency with our insights on the full load current of motor, key to optimizing your machinery's performance.